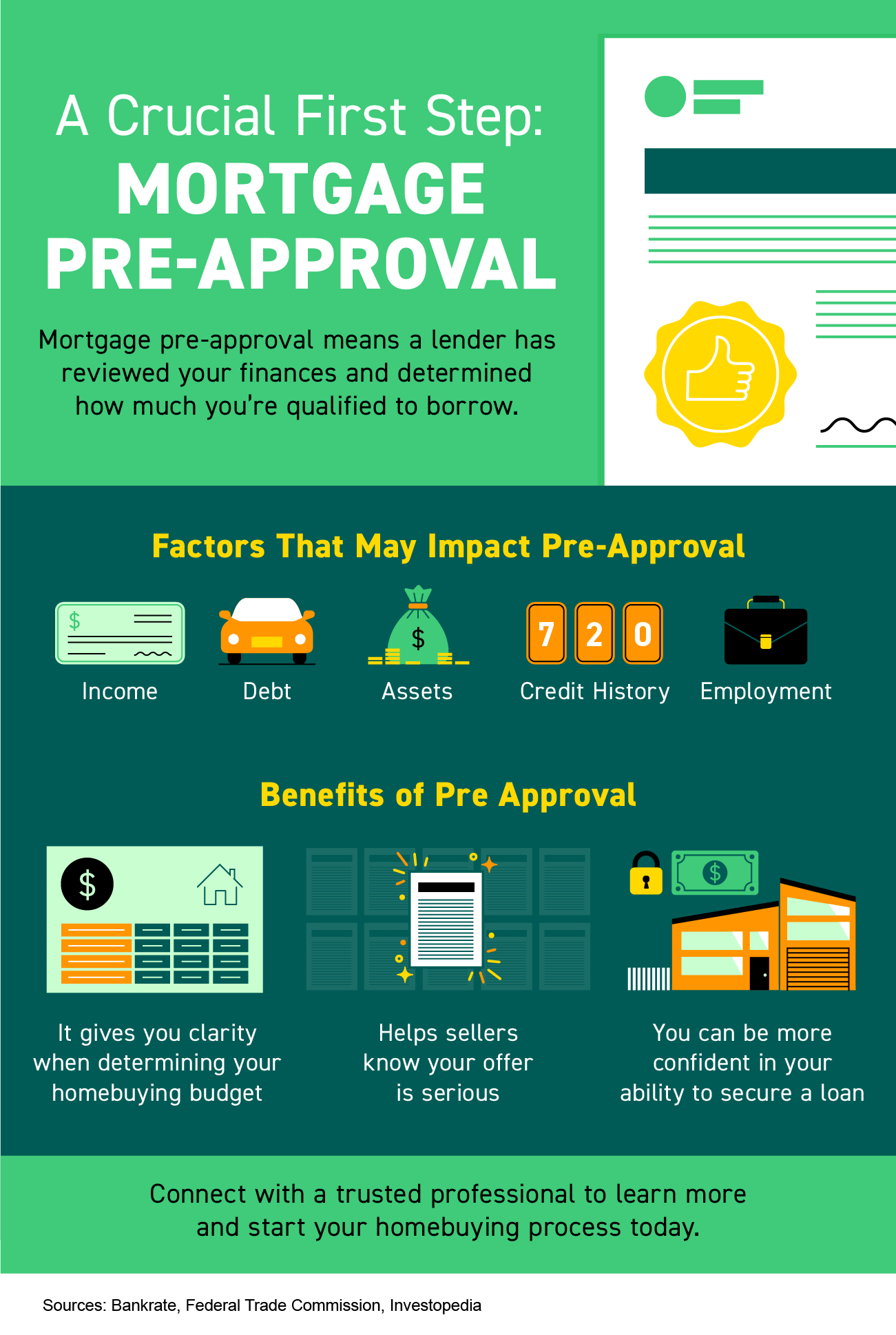

How to Receive a Mortgage Pre-Approval

It can be difficult to shop for a home in Missouri without knowing how much you can afford. Getting a pre-approval for a mortgage is a smart first step in the home buying process and will help you move forward with confidence. Here’s what you need to know about receiving a mortgage pre-approval. What is […]

Who Are the Best Mortgage Lenders in Kansas City

Now, is the right time to be in Kansas City if you are in the market for a home and require a loan. Mortgage lenders in the Kansas City area are offering flexible buyer options for people hoping to own a home. National lenders, too, are offering opportunities for a wide variety of potential home […]

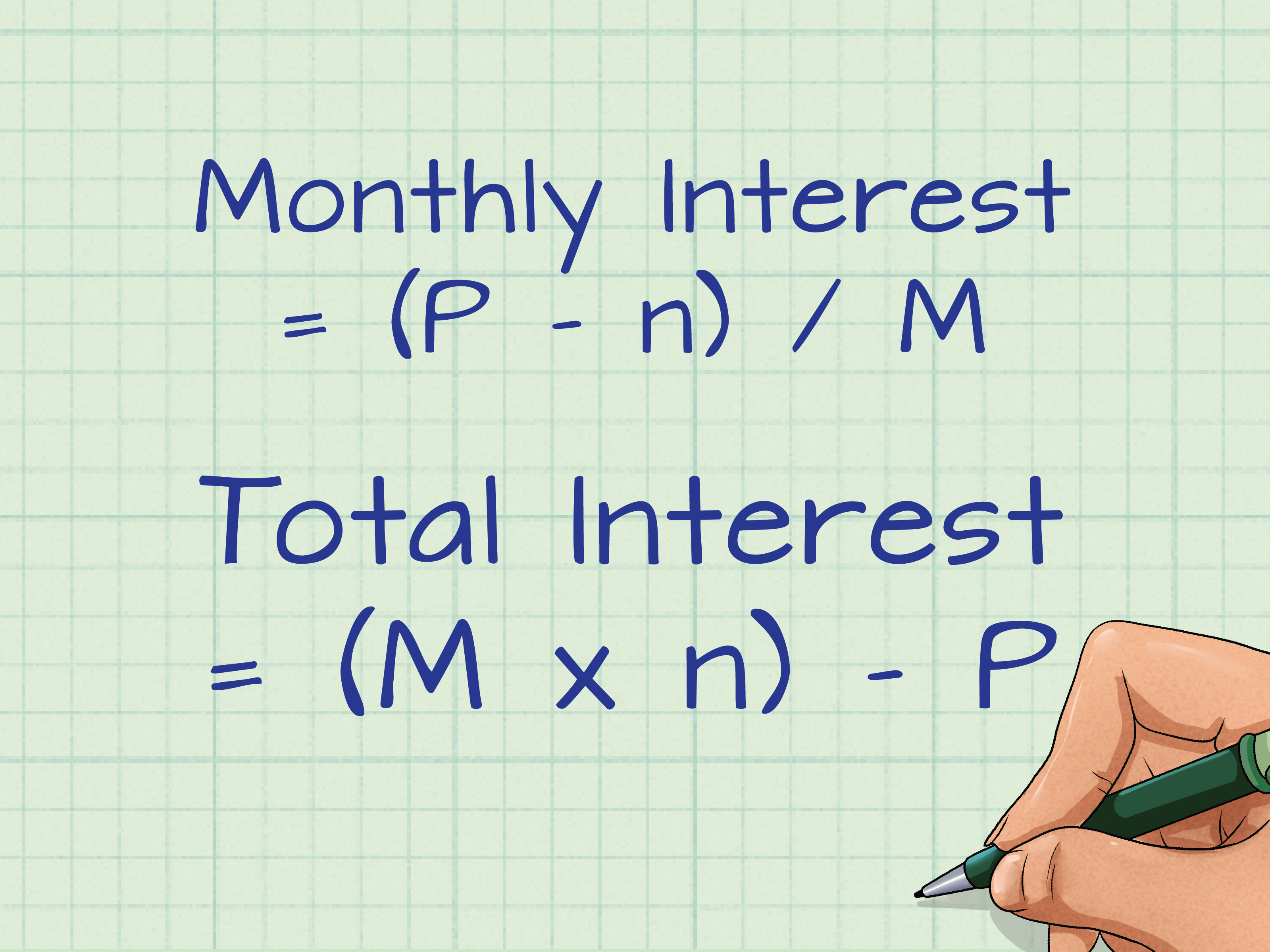

Bi-Monthly Mortgage Payments

Making bi-monthly payments makes a mortgage payment plan manageable. Lump-sum monthly mortgage payments — for many homeowners — is untenable. In addition to the fact that a bi-monthly payment plan relieves the stress of making a huge payment at the beginning or end of each month, there are additional benefits of a bi-monthly payment structure. […]

KC Mortgage Rates: What’s the Current Outlook?

According to CNBC.com; we opened 2019 with a sharp drop in KC mortgage rates to the lowest level since April 2018 – sparking a mini-boom in mortgage refinancing. Mostly due to a stagnant holiday season which, if you ask anyone in the mortgage business, is pretty normal. What does this mean? Mortgage rates can be […]

Cash Out Refinancing

Your Home Is Your Most Valuable Asset If you own your home, chances are that you’ve been told it’s your most valuable asset. In the current market it may even be an appreciating value, meaning it’s worth more now then when you bought it. However, the value in your home isn’t usually very liquid. It […]

So You Paid Off Your Mortgage, Now What?

Are You Finally Mortgage Free? Have you been paying diligently on your mortgage for years and years? Maybe you’ve made a few extra payments occasionally, or just a monthly payment for thirty years, but now you’ve finally sent in your last payment. First off, congratulations! Now there are a few steps to take to ensure everything […]

Mortgage Insurance

You finally found the perfect home for your family, but unfortunately you don’t have the 20 percent down payment that your lender requires to finance your loan. Qualifying for a home loan can be difficult sometimes, especially if you have less than perfect credit or other risk factors that a lender might see. Don’t fret […]

How much impact $1 can have on your mortgage?

Do you know how much your total mortgage costs? Did you know you could easily reduce that amount? Let’s look at a typical mortgage, According to Capital Economics analysts the average American mortgage in 2012 was $235,000 while most people take a 30 years mortgage. The national average of 30 years fixed rate mortgage is […]