It can be difficult to shop for a home in Missouri without knowing how much you can afford. Getting a pre-approval for a mortgage is a smart first step in the home buying process and will help you move forward with confidence. Here’s what you need to know about receiving a mortgage pre-approval.

What is a Mortgage Pre-Approval?

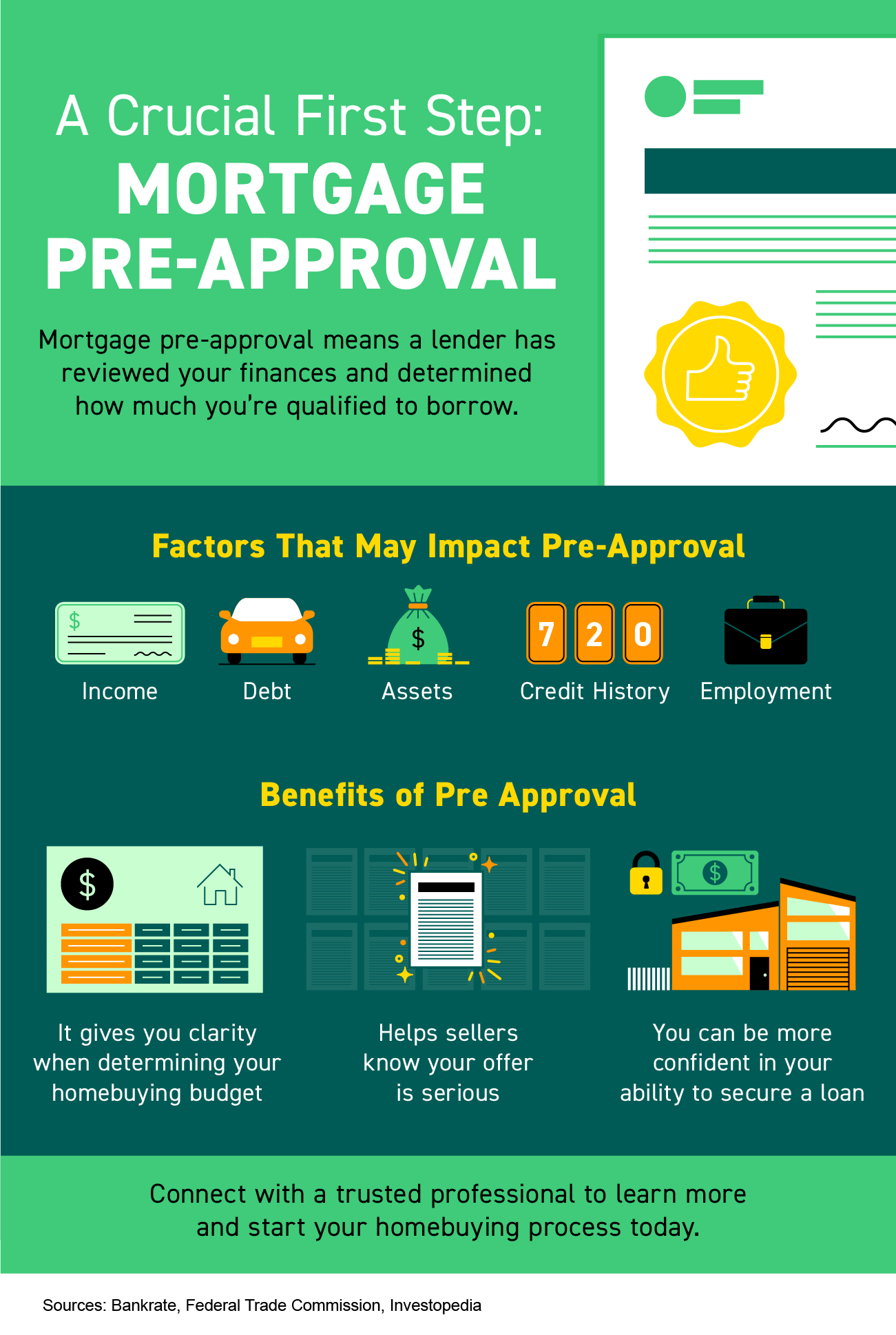

Mortgage pre-approval is a process to determine how much money mortgage lenders are willing to lend you to purchase a home. During the pre-approval process, the lender will review your credit score, debt-to-income ratio, and assets to determine eligibility for a mortgage, how much you can borrow, and your interest rate.

Why is Pre-approval Necessary?

Receiving a mortgage pre-approval is essential because it will:

- Help you determine what you can afford

- Help you shop for a home within your budget

- Put you in a stronger negotiating position with sellers

- Help you avoid being taken advantage of by unscrupulous real estate agents

- Speed up the home buying process

What is the Difference Between Prequalification and Preapproval?

Preapproval and prequalification are both ways to measure how much money a lender is willing to lend you, but they are not the same thing. Prequalification is the first look at your financial situation based on self-reported information.

Since you are not required to provide any financial documentation, such as bank statements and pay subs, prequalification is less commitment than a pre-approval. The lender will just give you a rough estimate of what you may be able to borrow, and it may change once they have reviewed your financial documents.

Approval

Although a pre-approval is helpful when shopping for a home, you will need to get approval before you actually buy a home. Therefore, getting a pre-approval does not guarantee receiving a loan from the lender. Still, it puts you in a much better position to be approved since you have already provided the lender with all your financial information.

However, there are other factors related to the home purchase that the mortgage companies will also consider, such as:

- Appraisal Value: Your lender will order an appraisal of the home you wish to purchase to ensure that the house is worth the amount you are borrowing. If the appraisal value is less than the purchase price, you may need to bring more money to the closing table.

- Home Inspection: A home inspection is not required for a mortgage, but some mortgage lenders may require it to meet their guidelines. For instance, if you use FHA loans to buy a house in Missouri, structural issues like cracks in the foundation or water damage could lead to the loan being denied.

- The Title: The lender will also want to make sure that the person selling you the home owns the property and that there are no liens or judgments against it.

How to get a Mortgage Pre-approval

Before you get a mortgage pre-approval, you need to work with your chosen Missouri mortgage lenders to verify your eligibility and begin the application process. Let’s look at all the steps you need to take to obtain a mortgage pre-approval:

Get Your Documents Ready

The pre-approval process is like filling out the mortgage application, so the lender will require you to look at some of your personal information and your credit history. You should be thus prepared with the following documents:

- Identification

- Proof of Income

- Employment history for the past two years

- Proof of Assets

- Credit History

The lender may also require you to provide additional documents to review the aforementioned things. This includes:

- Bank statements

- Pay stubs,

- W-2 forms

- Social Security award letter (for those receiving Social Security benefits).

Once you have submitted all the required documents, the lender will review your file, and you can expect to receive a pre-approval letter within ten days to two weeks. The pre-approval letter will state the maximum loan amount you are approved for and the interest rate you will pay.

Give Your Credit Score a Good Check

During the pre-approval process, your credit score will undergo hard inquiries by the lender. While this may cause a slight dip in your score, it will rebound after a few months if you make all of your payments on time.

Getting a preapproved generally does not affect your ability to get a mortgage, but you must give your credit score a check before applying for the loan. If you find any errors on your credit report, you can dispute them with the credit bureau. It’s also a good idea to improve your credit score before applying for a mortgage.

You can improve your credit score by:

- Paying all of your bills on time

- Keeping your credit card balances low

- Avoiding opening new lines of credit

- Disputing errors on your credit report

- Making timely payments on loans and other debts

What’s Next After You’re Pre-Approved?

You will receive a pre-approval letter once the lender considers you eligible for the mortgage.

With this letter in hand, you are in a better position to negotiate with sellers and get a lower interest rate on a loan. Even the real estate agents prefer to work with buyers who have a pre-approval letter because it shows that you are serious about buying a home.

A pre-approval letter is generally valid for 60-90 days. Unfortunately, if you do not find a property to buy in Missouri within this time frame, you will need to go through the pre-approval process again. However, the good news is you can request renewal of your pre-approval letter by giving your most up-to-date financial and credit information to the lender.

Get in Touch with a Mortgage Specialist Today!

Getting a mortgage pre-approval from your chosen mortgage lender is an essential first step in the home buying process. If you have not already done so, we recommend that you contact a mortgage specialist to learn more about your options and what you need to do to secure financing.

A1 Mortgage Company is an excellent resource for first-time homebuyers. We offer a wide variety of programs to help you get the financing you need, including FHA, conventional loans, and other government-backed programs in Missouri. Get in touch with our mortgage lenders in Missouri to bring you one step closer to owning the home of your dreams. Happy house hunting!