Making bi-monthly payments makes a mortgage payment plan manageable.

Lump-sum monthly mortgage payments — for many homeowners — is untenable.

In addition to the fact that a bi-monthly payment plan relieves the stress of making a huge payment at the beginning or end of each month, there are additional benefits of a bi-monthly payment structure.

Retire Your Loan Early with a Bi-Monthly Payment Structure

One benefit of a bi-monthly mortgage payment plan is that by deciding on one, you pay off your loan quicker. A monthly lump-sum payment means 12 payments per year. That is not the case with a bi-monthly payment plan.

Because all but one month in a calendar year contains more than 28 days, there are 52 weeks in a year instead of 48. So, with a bi-monthly plan, you make an extra month of payments each year.

That means, every 12 years, you’ve advanced ahead of schedule by a year.

Accumulate Home Equity More Quickly

Again, because you make the equivalent of 13 months of payments every calendar year, you are building equity at a faster rate with a bi-monthly payment plan.

Home equity is useful for acquiring home equity loans if you are interested in home improvements or you have to repair your home. Home equity also means gaining more profit if you sell your home before the term of your loan. That means you can choose to do things like the additional equity it to cover things like closing costs if you decided to sell.

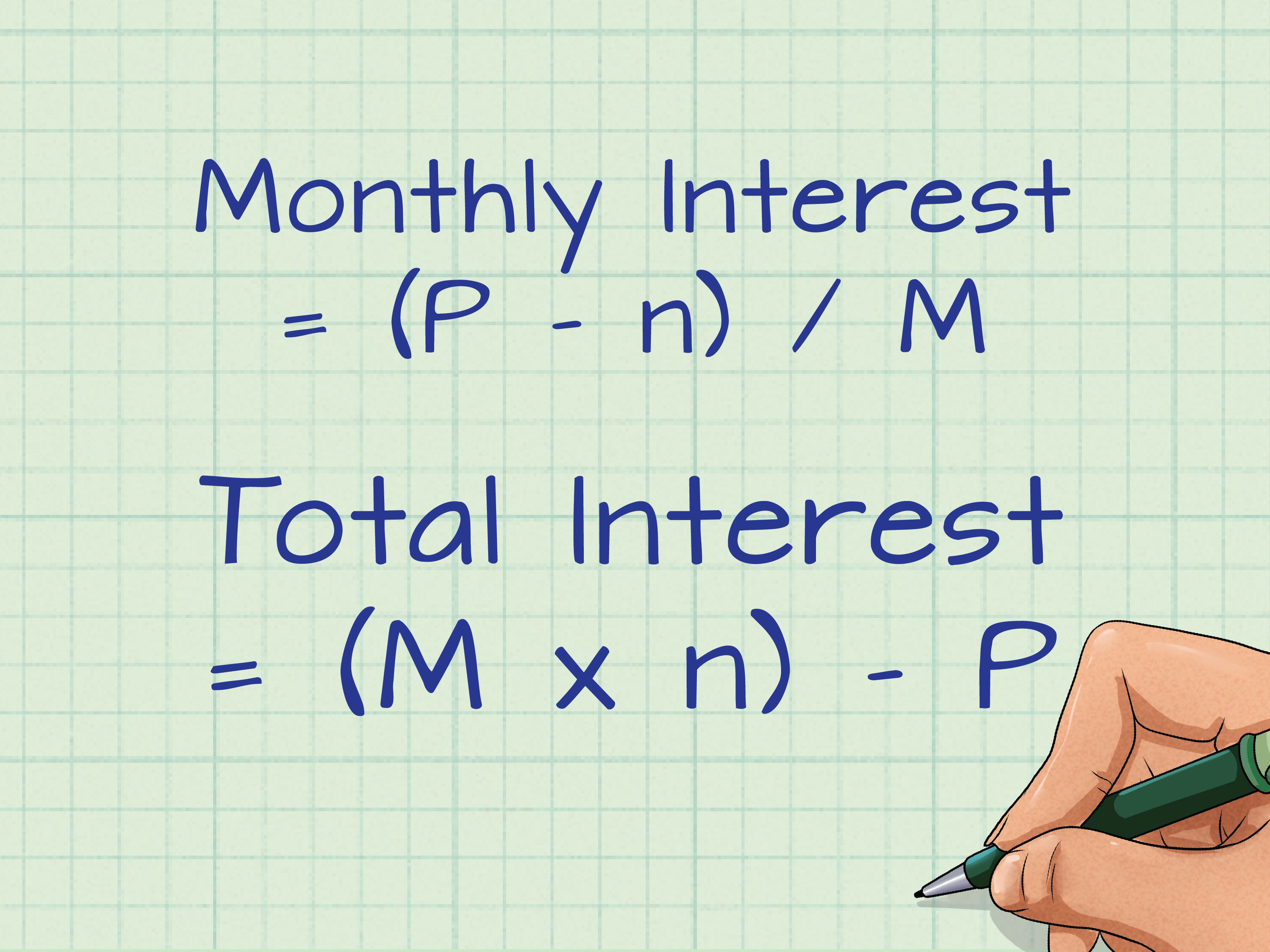

Reduce interest payments

At the beginning of a loan term, the majority of each payment goes toward paying off interest as opposed to the principal of a loan balance.

So, at the beginning of a loan term, you make very little headway with respect to principal payments. Again, since bi-weekly payments result in 13 months of payments every 12, you begin paying off the principal of the loan faster.

Shed Your Private Mortgage Insurance (PMI) Payment Sooner

Generally, home purchasers are required to put down 10 percent up front to buy a home using a Kansas City mortgage broker.

Not everyone has the capital to make a payment that large, however. With the majority of conventional loans, if your down payment is less than 20 percent, home buyers are required to pay for private mortgage insurance. Mortgage insurance is added to the sum of each mortgage payment every month. The rationale for mortgage insurance is simple. It protects lenders from the potential of default.

By paying bi-monthly, you can shed the PMI burden sooner. Once your equity reaches 20 percent of the value of the loan, you are no longer required to pay private mortgage insurance.

Contact A1 Mortgage in Kansas City to discuss the even more benefits of a bi-monthly payment plan.