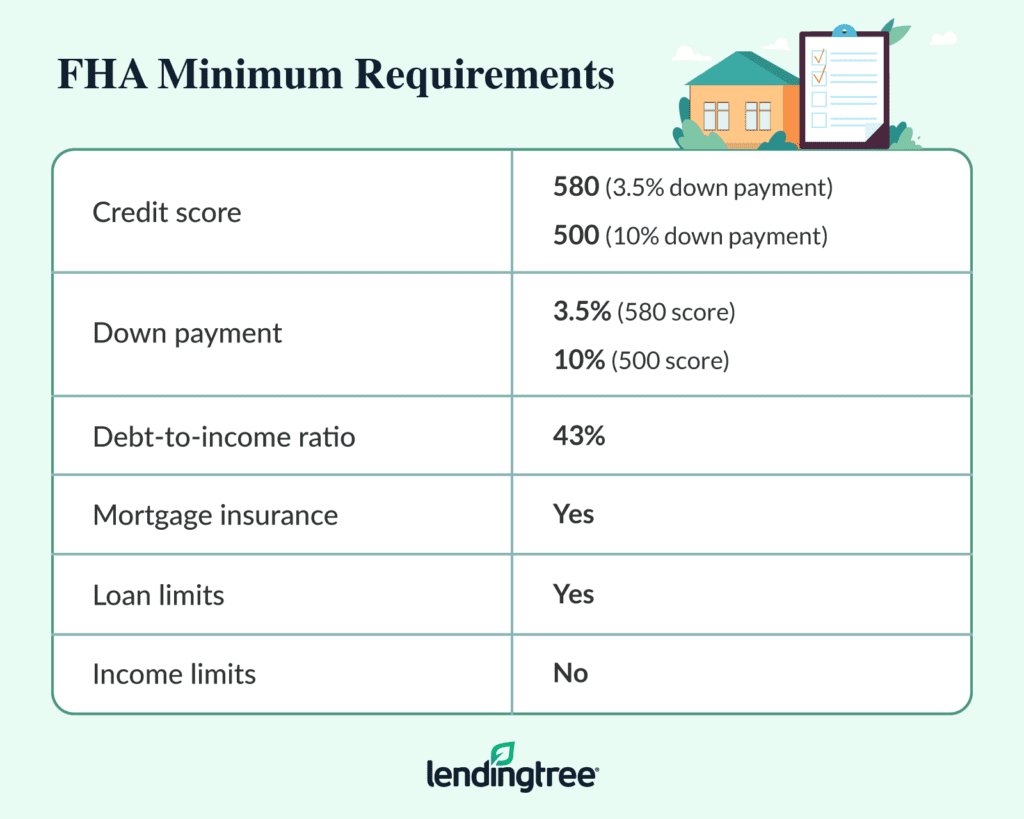

2022 FHA Loan Guide: Requirements, Rates, and Benefits

If you want to buy your first home in Missouri, consider an FHA loans. Tailored especially for first-time homebuyers, the FHA loan program offers low down payment and credit score requirements making it easier to qualify. For example, with an FHA loan, you can put as little as 3.5% down on a home, and with […]

Cash-Out Refinance: What is it and How Does it Work?

Do you have equity in your home that you want to use for significant expenses? If you want to use your equity and lower your monthly mortgage payment at the same time, a cash-out might be an excellent option for you. In a cash-out refinance, you replace your current mortgage loan with a new one […]

Refinancing Your Mortgage Without an Appraisal

If you’re looking to refinance your mortgage, you may wonder if you can do so without getting an appraisal. After all, appraisals can be costly and time-consuming. Well, the good news is that, yes, you can refinance without an appraisal. It makes the entire process much easier and faster, as you don’t have to run […]

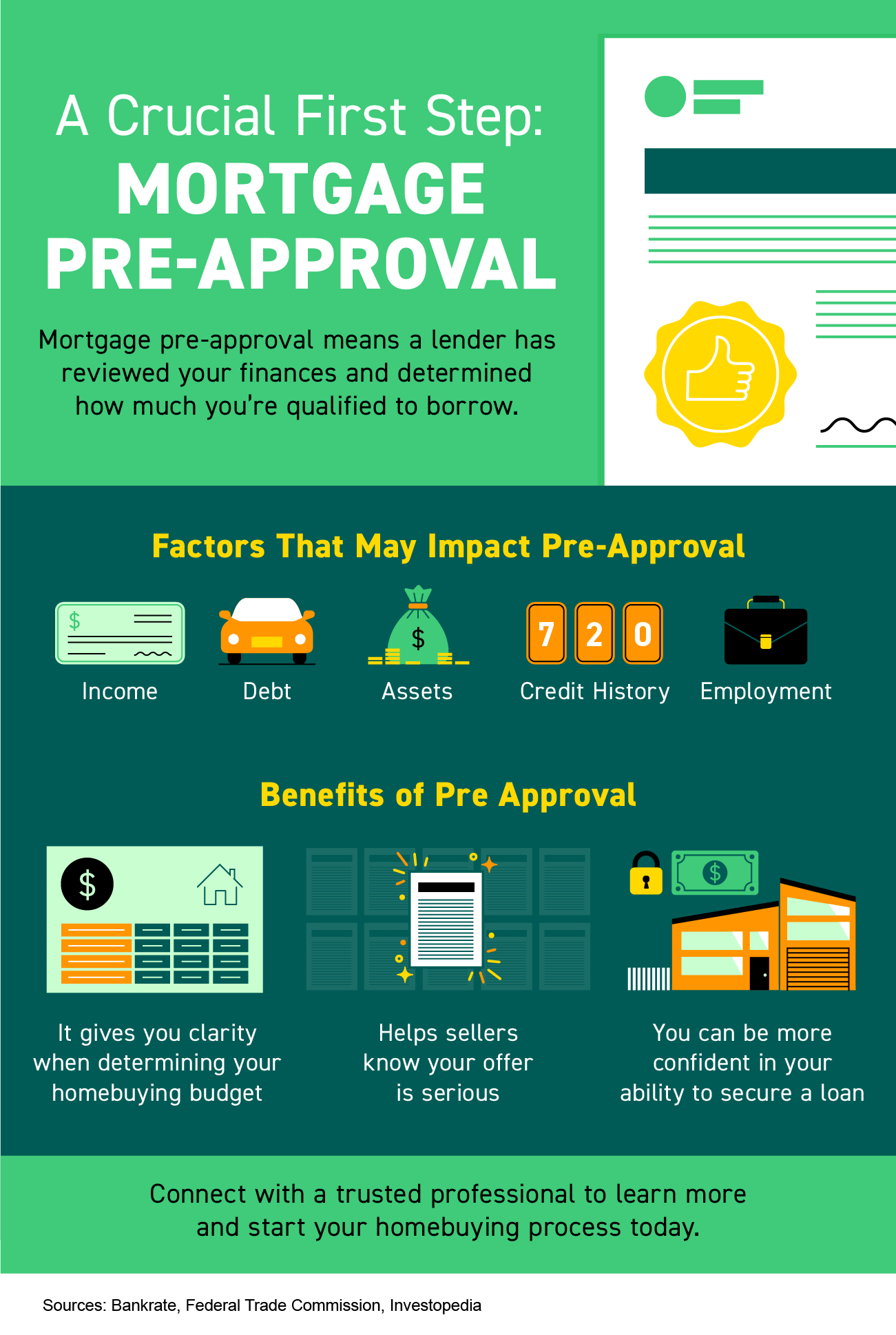

How to Receive a Mortgage Pre-Approval

It can be difficult to shop for a home in Missouri without knowing how much you can afford. Getting a pre-approval for a mortgage is a smart first step in the home buying process and will help you move forward with confidence. Here’s what you need to know about receiving a mortgage pre-approval. What is […]

Is December a Good Time to Purchase a Home?

It is unquestionably less pleasant to shop for homes in December – the weather can be treacherous and darkness prevails. But if you’re savvy — and willing to brave the elements — shopping in the low season might get you into a home at a discount compared to prices in peak home-shopping months. Here are […]

Why Now is the Time To Buy A New Home or Refinance Your Loan

As anyone who has tried to buy a home or apply for a loan can tell you, a tiny change in interest rate can lead to big changes in the amount the borrower pays to the lender. Interest rates and mortgage rate in the U.S. have been at historic lows for over a decade, but […]

Housing and Mortgage Trends to Watch In 2019

Housing and Mortgage Trends to Watch In 2019 2019 is predicted to be a challenging year for home buyers. The competitions for homes due to short supply will continue and mortgage rates are likely to keep moving upward, limiting affordability. Our take on housing and mortgage trends to watch in 2019 is outlined in this […]

Why December is a Great Time to Purchase a Home

It is unquestionably less pleasant to shop for homes in December – the weather can be treacherous and darkness prevails. But if you’re savvy — and willing to brave the elements — shopping in the low season might get you into a home at a discount compared to prices in peak home-shopping months. Here are […]

Refinance Your Home – Everything You Need to Know

If you have equity in your home and rates are low it might be a good time to consider refinancing your loan to decrease monthly payments and lock in a lower rate. However, there are several things to consider before deciding whether refinancing your home loan is right for you. Credit Score Lenders have tightened their […]

Selling Your Home During the Holidays? You Must Be Serious

Surprising as it may sound there are advantages to selling your home in the winter months. Many home sellers remove their home from the market during the “winter blues” which makes competition and inventory lower – giving you the advantage. There are a few hurdles however, which means you must be serious when selling your […]