If you want to buy your first home in Missouri, consider an FHA loans.

Tailored especially for first-time homebuyers, the FHA loan program offers low down payment and credit score requirements making it easier to qualify. For example, with an FHA loan, you can put as little as 3.5% down on a home, and with today’s historically low-interest rates, you could save thousands of dollars over the life of your loan.

But home buyers are not the only ones who benefit. Homeowners can also refinance with an FHA loan without excellent credit and still enjoy a low-interest rate. Still not sure whether you will qualify or not? A1 Mortgage lenders in Missouri can help you understand everything you need about FHA loans, including the requirements, benefits, and interest rates.

What is an FHA Loan?

An FHA loan is a mortgage insured by the Federal Housing Administration (FHA) and is available for purchase mortgages and refinance loans. The FHA program was created during the Great Depression to stimulate the economy and get people back into home ownership.

Over time, the FHA has become one of the most popular loan programs available, as it offers several benefits that other loans do not.

The most notable is the low down payment requirements. With an FHA loan, you can put as little as 3.5% down on a home, which is significantly lower than the 20% required by most conventional loans. Another significant advantage is the relaxed credit score requirements. With an FHA Missouri loan, you can qualify with a credit score as low as 580. For many people, this is a very attainable goal and opens homeownership to a whole new group of people.

Finally, Since the government backs FHA loans, they can offer competitive interest rates. Now that we’ve covered what an FHA loan is, let’s look at some of the requirements you’ll need to meet to qualify.

How do FHA Loans work?

The first thing to understand about FHA loans is that the FHA does not issue them. Instead, they are issued by private mortgage lenders, and the FHA insures them against default.

This means that if you default on your loan, the FHA will pay off your mortgage lenders in Missouri. In addition, this guarantee allows lenders to offer FHA loans with much more relaxed qualification requirements than they would otherwise be able to offer.

The FHA charges a mortgage insurance premium (MIP) on all FHA loans in exchange for this guarantee. The MIP is a fee that the borrower pays and protects the lender in case of default.

The MIP is paid as an upfront premium, as well as an annual premium. The upfront premium is 1.75% of the loan amount, and the yearly premium is between .45% and 1.05%, depending on the length of the loan, the amount of the down payment, and the borrower’s credit score.

FHA Loan Requirements

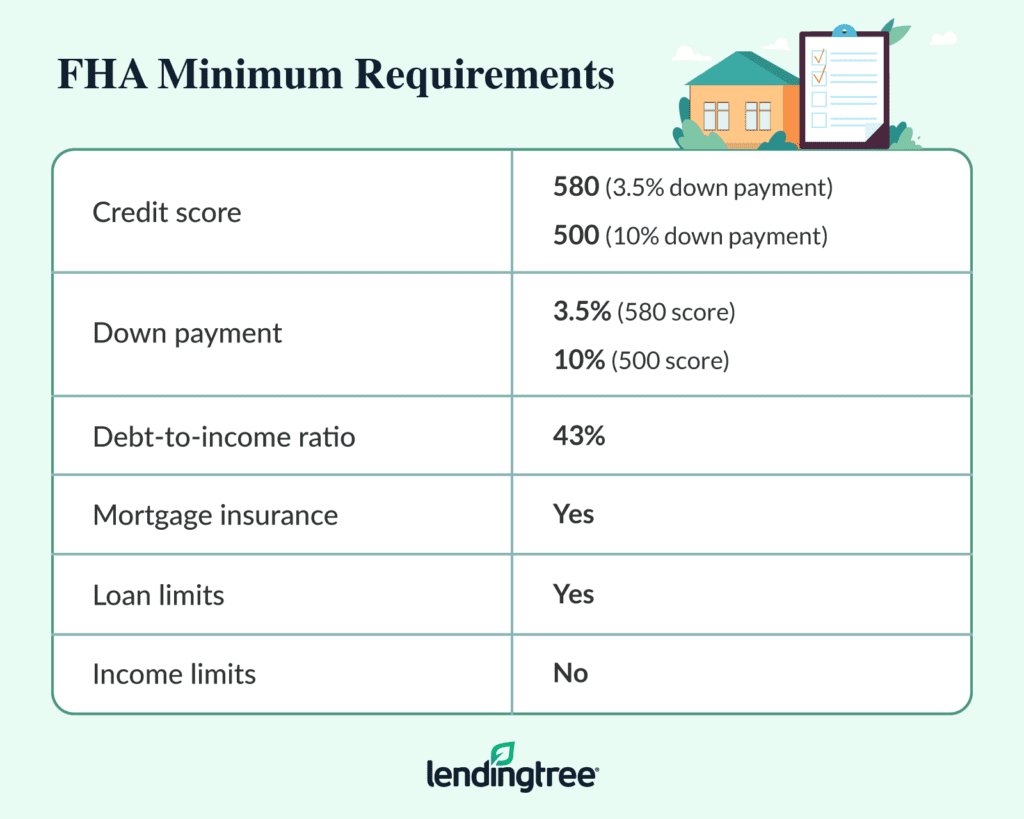

To qualify for FHA loans in Missouri, you’ll need to meet the following requirements:

- A 3.5% down payment if your credit score is 580 or higher. If your credit score is between 500 and 579, you’ll need to put down 10%.

- A debt-to-income ratio (DTI) of no more than 50%

- Steady employment history for at least two years

- An FHA loan is applied for primary residence only (no investment properties)

- No foreclosure or bankruptcy in the past three years

These requirements are a lot more relaxed when compared to other loans, like conventional loans. This is one of the reasons why FHA loans have become so popular in recent years.

For instance, with a conventional loan, you’ll need a minimum credit score of 620 and a down payment of 5%. In addition, you’ll need a DTI of no more than 43%.

As you can see, the requirements for an FHA loan are much more attainable for the average person who does not have a super high credit score or a lot of money saved up for a down payment.

FHA Loan Rates

FHA loans usually have below-market interest rates, making them easier to qualify for than conventional loans.

FHA Missouri loans have some of the lowest mortgage rates in the current market.

A 30-year fixed FHA loan rate starts at 6% for borrowers with solid credit scores. By comparison, a conventional mortgage begins at 5.75% for a similar loan.

Note that the APR on an FHA loan will be slightly higher than that on a conventional loan because of the mortgage insurance premiums required with an FHA loan.

Also, for borrowers putting a 3% down payment on conventional loans compared to 3.5% on FHA loans, the APR would look much closer to FHA loans.

FHA Loans Benefits

There’s a lot to like about FHA loans offered by FHA-approved mortgage companies.

Here are some of the key benefits:

-

Low Down Payments

An FHA loan is an excellent option for homebuyers looking for options that allow them to put less money down.

With as little as a 3.5% down payment required, buyers do not have to use their life savings to create a down payment—something they would rather spend on other aspects of their life.

-

Gift Funds Allowed

FHA loans are generous regarding the source of your down payment. Not only can you use your savings, but you can also use gifts from family members, friends, or even your employer. To qualify for a gift, you’ll need a letter from the person giving you the money that states that it is a gift and not a loan.

This makes it much easier for people to come up with the money for a down payment, especially if they are first-time homebuyers.

-

Higher Debt to Income Ratios Accepted

FHA loans also allow for higher debt-to-income ratios than most other loan types. Your DTI is calculated by taking your monthly debt payments and dividing them by your monthly income.

For instance, if you have a monthly mortgage payment of $2,000 and your monthly income is $5,000, your DTI would be 40%.

Officially FHA maximum DTI ratios are 31/43. However, some leeway is given with decisive compensating factors like large down payments or reserve funds.

-

Lower Credit Score Requirements

FHA loans have more flexible credit score requirements than other loan types. For an FHA loan, you can qualify for a loan with a credit score as low as 580. However, if your credit score is below 580, you’ll need to put down 10% instead of 3.5%.

The requirements are a lot more relaxed when compared to other loans, like conventional loans. This is one of the reasons why FHA loans have become so popular in recent years.

-

Bankruptcy & Foreclosure

FHA loans are also more forgiving when it comes to bankruptcy and foreclosure.

If you’ve gone through bankruptcy, you’ll need to wait two years before qualifying for an FHA loan. And if you’ve gone through a foreclosure, you’ll need to wait three years.

-

Low Rate on FHA Streamline

If you currently have an FHA loan, you may be able to refinance into another FHA loan through the FHA streamline program offered by Missouri mortgage lenders.

The best part about this program is that there’s no income verification, no employment verification, or credit check required, which is ideal for self-employed or who have unstable incomes.

In addition, the FHA streamline program offers meager mortgage rates.

Key Takeaway

The FHA loan program is an excellent option for homebuyers looking for an alternative to conventional loans. With more relaxed requirements and lower interest rates, FHA loans offer many benefits that other loan types simply can’t match.

If you’re considering buying a home, explore your FHA loan options with the reliable A1 Mortgage from your local mortgage lenders! We offer some of the lowest FHA loan rates in the business, so you’re sure to get a great deal on your new home loan. So give us a call today to learn more!