Home Builders Cautious About Market

Typically, home builders are a good gauge of the future housing market. After all, their business depends on being able to tell when and where home buyers are looking to buy. So their perspective on the market for new homes is a good indicator of housing health. The National Association of Home Builders measures how […]

Active Listings Grow For First Time In Years

The number of homes for sale has been lower than normal for years now. Home shoppers looking for a home to buy have had to compete over limited listings, which has led to bidding wars, rising prices, and frustration. But things may finally be changing. In fact, the number of active listings rose in May […]

Large Suburbs See New Home Construction Dip

Pandemic-related lockdowns made many Americans want more space. So when home buyers came back to the market, sales in the suburbs heated up. Buyers wanted bigger homes, larger yards, more privacy, and room for a home office. That trend continued throughout the pandemic. But now that things have opened up and fewer of us are […]

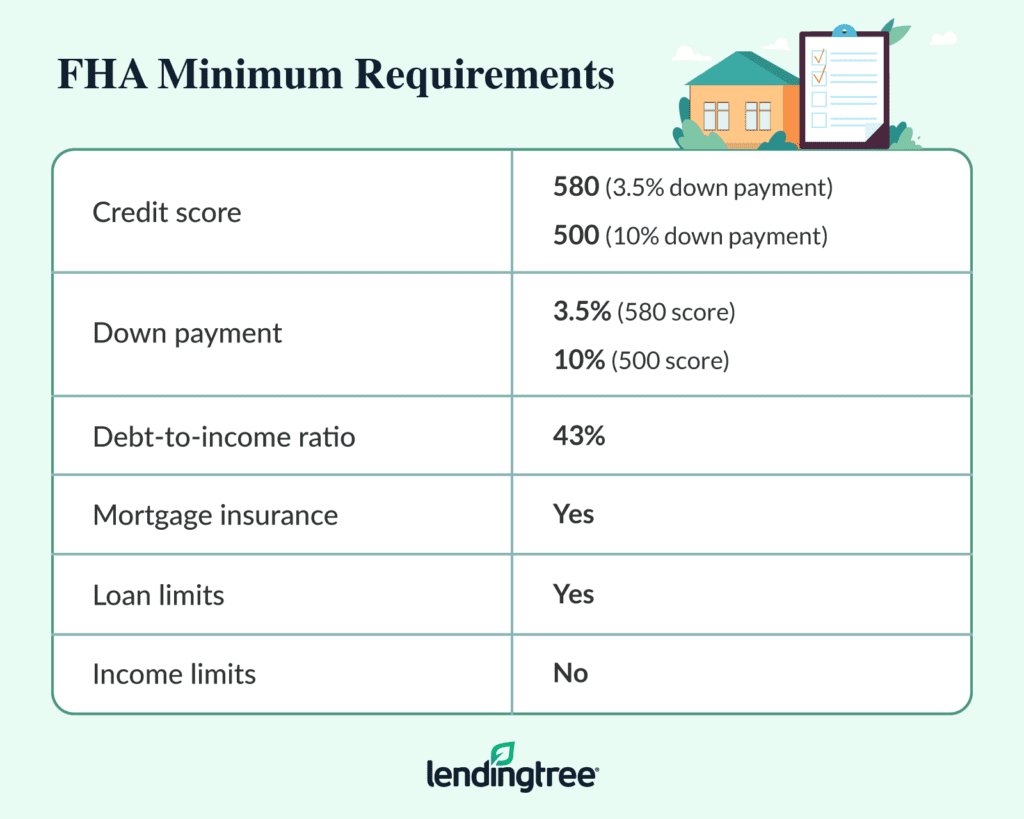

2022 FHA Loan Guide: Requirements, Rates, and Benefits

If you want to buy your first home in Missouri, consider an FHA loans. Tailored especially for first-time homebuyers, the FHA loan program offers low down payment and credit score requirements making it easier to qualify. For example, with an FHA loan, you can put as little as 3.5% down on a home, and with […]

Americans Say It’s A Good Time To Sell

Fannie Mae’s monthly Home Purchase Sentiment Index measures how Americans feel about the housing market and economy. It asks respondents whether they think it’s a good time to buy or sell a house, whether they believe home prices and mortgage rates will rise or fall, and how they feel about their job and financial situation. […]

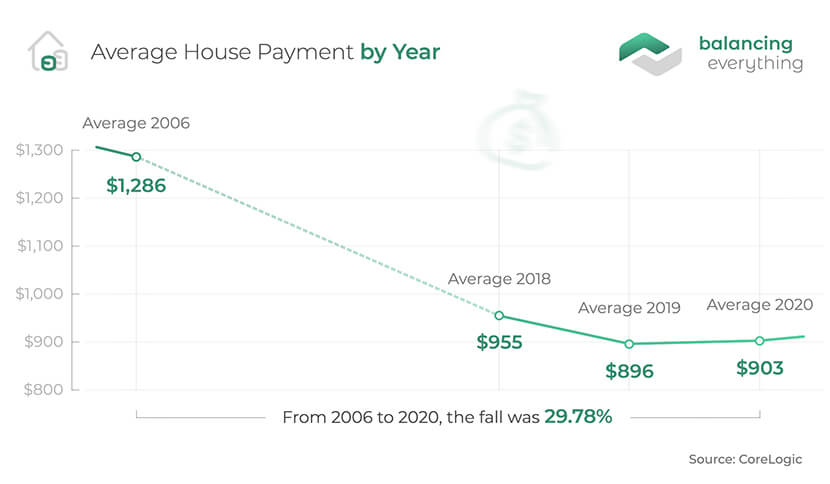

Typical Mortgage Payment Increased In April

Calculating how much house you can afford can be difficult. You have to take your budget into account and keep up on changes in the housing market. That’s particularly tricky these days with rising interest rates and mortgage payment. Quickly changing affordability conditions mean potential buyers have to regularly recalculate costs. Especially when one calculates […]

How Many Showings Does The Typical Listing Have?

Every homeowner with a home to sell wants to attract qualified buyers. After all, the more interest there is in your home, the more likely it is that you’ll get a good offer. One way to measure interest is to pay attention to how many buyers are scheduling showings to tour your house. But how […]

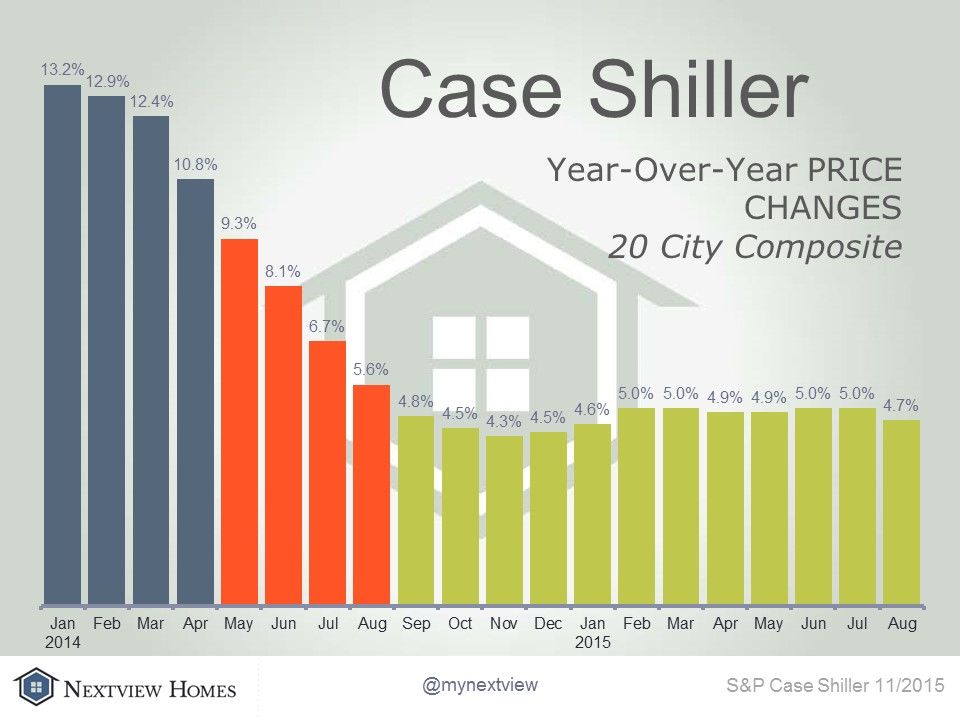

When Will Home Price Increases Slow Down?

These days, it seems like most housing market forecasts are predicting home price increases will begin to slow at some point this year. Whether it’s due to improving inventory levels as the number of homes for sale rises or from slower demand due to higher mortgage rates, most industry outlooks say the price spikes of […]

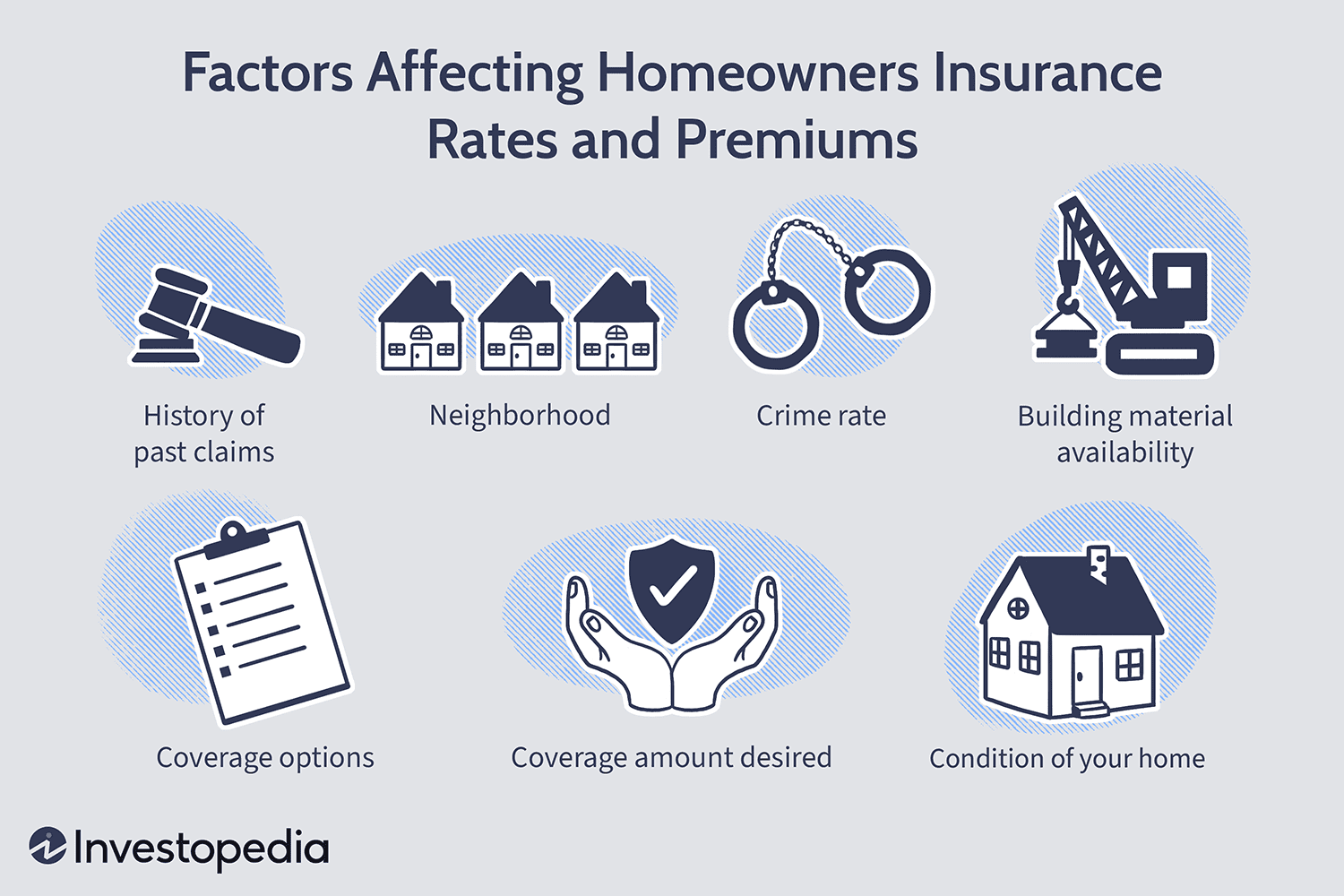

What To Know About Home Insurance Rates

Home insurance isn’t required by law but, most likely, your lender’s going to require it to get a mortgage. Even if they didn’t, it’d probably be in your best interest to have some coverage. After all, the most common home insurance claims are damage from wind, hail, water, fire, and lightning. In other words, wherever […]

Home Buyers Certainty Could Soon Stabilize

The National Association of Realtors’ Pending Home Sales Index is an indicator for future home sales, measuring contract signings rather than closings. Generally speaking, contracts to buy are signed weeks before a sale is closed, which means a drop in the number of signed contracts will most likely show up as a decline in home […]