Is December a Good Time to Purchase a Home?

It is unquestionably less pleasant to shop for homes in December – the weather can be treacherous and darkness prevails. But if you’re savvy — and willing to brave the elements — shopping in the low season might get you into a home at a discount compared to prices in peak home-shopping months. Here are […]

Why December is a Great Time to Purchase a Home

It is unquestionably less pleasant to shop for homes in December – the weather can be treacherous and darkness prevails. But if you’re savvy — and willing to brave the elements — shopping in the low season might get you into a home at a discount compared to prices in peak home-shopping months. Here are […]

Refinance Your Home – Everything You Need to Know

If you have equity in your home and rates are low it might be a good time to consider refinancing your loan to decrease monthly payments and lock in a lower rate. However, there are several things to consider before deciding whether refinancing your home loan is right for you. Credit Score Lenders have tightened their […]

Building A Home – Steps To Take For New Construction

Getting A Mortgage When Building A Home Getting a home loan on a house you’re thinking of purchasing is fairly straight forward. What about when you are building a home? There is extra research and a few extra steps you need to take during this process to ensure you are on the right path. You […]

So You Paid Off Your Mortgage, Now What?

Are You Finally Mortgage Free? Have you been paying diligently on your mortgage for years and years? Maybe you’ve made a few extra payments occasionally, or just a monthly payment for thirty years, but now you’ve finally sent in your last payment. First off, congratulations! Now there are a few steps to take to ensure everything […]

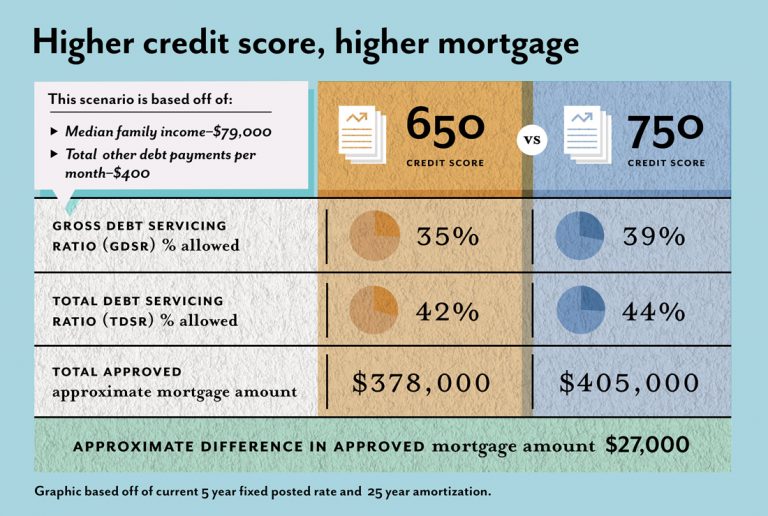

What You Need To Know About Your Credit Score

Do you know your credit score? The range of a credit score is between 300-850, with the average score being 600. Read more from A1 Mortgage in Kansas City

Building Better Credit

It’s never too early to start building better credit, let alone repairing damaged credit. It takes time to up your score, but with a few simple steps you’ll be on your way to improving your credit score and being a lender’s dream client.