Why Is My Credit Score Important And What Are The Determining Factors

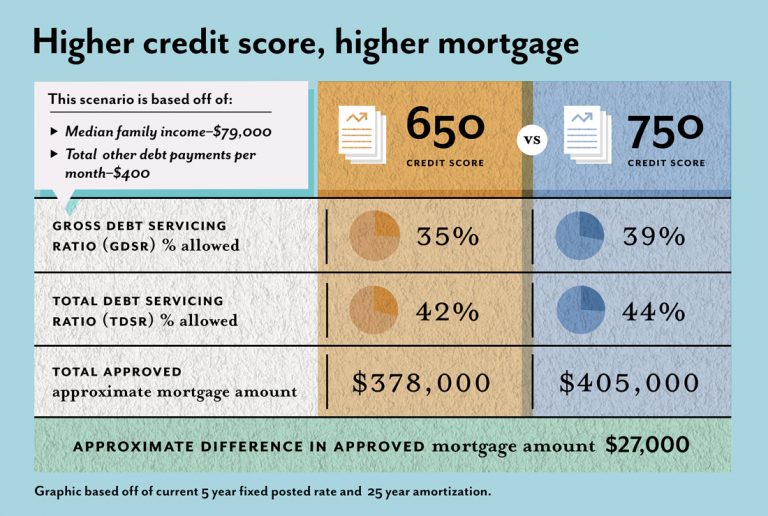

Before you even begin looking at homes, you should check your credit score. Your credit score determines how much of a risk you are to the lender and how much money you will have to put down for a down payment. It also determines the interest rate on your mortgage. They can even be used when you are renting a property, so you to need to know what state your credit is in. We are here to answer all the questions you might have about your credit score.

[clickToTweet tweet=”Do you know your credit score? The range of a credit score is between 300-850, with the average score being 600. Read more from A1 Mortgage in Kansas City” quote=”The range of a credit score is between 300-850, with the average score being 600. ” theme=”style6″]

This determines your creditworthiness. It is based on millions of credit transactions, purchase history, debt-to-income ratio and if your bills have been paid on time. While being debt free is a good thing, no credit is also bad credit. Lenders look for a history of a borrower being able to make payments and pay down debts.

Why Are There Three Different Credit Scores?

Equifax, TransUnion and Experian are the three FICO score providers and they provide three different credit scores for you. Each credit score vendor has a different approach and factors to determine your score. Some have several models designed for a particular purpose, such as auto lending or mortgage lending. In the case of mortgage lending, each borrower’s credit report comes with three credit scores, one from each of the three repositories. Most lender use the same score provider as a standard.

Links:

Equifax

TransUnion

Experian

My Score Online Versus The One My Lender Provides

Credit scores are ever changing and can be different from the time you look at your score online to when you get to actually taking out a mortgage. Your lender may have also gotten your score from a different provider than the one you chose. Certain credit scores can only be checked three times a year without penalty, while some you can check every day with no consequence. With all of the providers out there, scores are calculated differently often which accounts for the variance.

Know Your Score And How To Increase It

You should check your credit score at least once annually, and especially before you are going to make a big purchase. There are many free options for checking your score. Knowing your score can help you determine if you are qualified to make a large purchase and help get you a lower interest rate. Paying off or consolidating debt, paying bills on time always and lowering your debt to income ratio can raise your credit score into one you can be proud of. Do remember that it can take time to make a score raise, but a few missed payments and your score can drop like a rock.

More tips on how to increase your credit score

Want to know more about how your credit score can impact your next big purchase? We are here to help you with all of your mortgage needs! Call us at (816) 822-8888 or fill out the form below.

Get in touch today!

[style_builder_gravity_forms id=678]