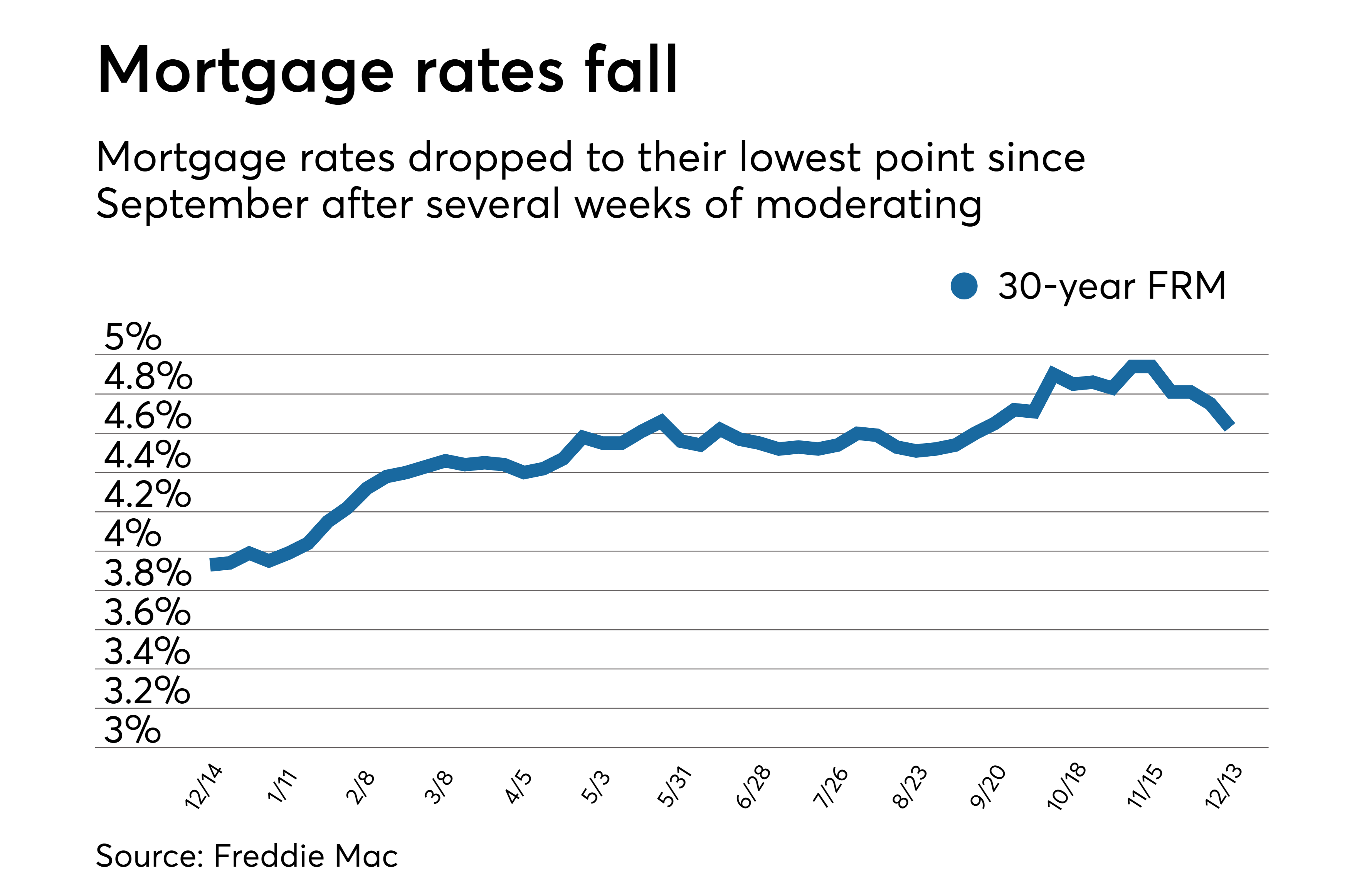

According to the Mortgage Bankers Association’s Weekly Applications Survey, average mortgage rates fell to a four-week low last week. Federal Housing Administration backed loans saw lower rates and 30-year fixed-rate mortgages with both conforming and jumbo balances. The decline helped push refinance activity up 2 percent from the week before. But while refinancing homeowners were more active, home buyers weren’t.

Mortgage Rates Hit Another Low

In fact, demand for loans to buy homes fell 3 percent from one week earlier. Joel Kan, MBA’s associate vice president of economic and industry forecasting, says the high end of the market is seeing more activity these days. “The average purchase loan increased for the second straight week to $416,200 – the second highest amount ever,” Kan said. “The elevated loan size is an indication that activity is more on the higher end of the market.” The MBA’s weekly survey has been conducted since 1990 and covers 75 percent of all retail residential mortgage applications. Click on the link for more information.

A1 Mortgage

Here at A1 Mortgage, we know how important it is to choose the right house for you and your companion. We have the responsibility to provide you with the best products and the highest level of customer service possible. With hundreds of loan programs available, we tailor a loan specific to your mortgage needs. So come get pre-approved and start shopping for your dream home by clicking here!