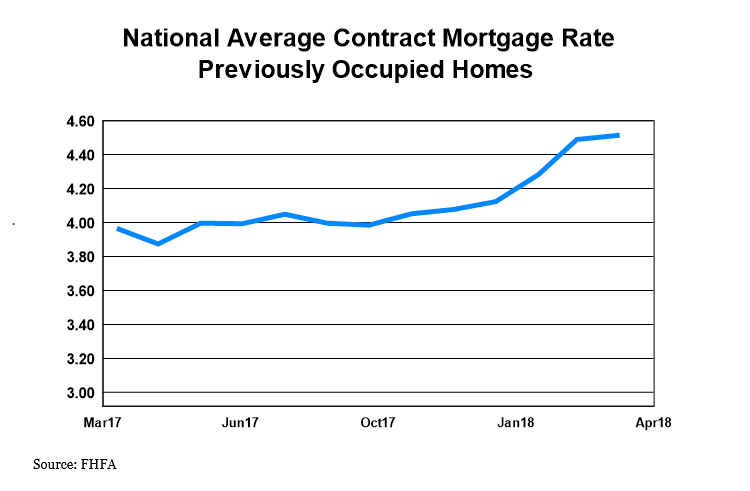

According to the Mortgage Bankers Association’s Weekly Applications Survey, average mortgage rates fell last week for 30-year fixed-rate loans with both conforming and jumbo balances. Loans backed by the Federal Housing Administration and 15-year fixed-rate loans were mostly flat from the week before. Declining rates led to a bump in mortgage demand which increased 0.7 percent, with refinance activity rising 2 percent week-over-week.

Mortgage Rates and Loan Size Fell

Joel Kan, MBA’s associate vice president of economic and industry forecasting, says demand from home buyers, while up slightly from the week before, has slowed this spring. “Overall purchase activity has weakened in recent months due to the quick jump in mortgage rates, high home prices, and growing economic uncertainty,” Kan said. But while demand may be slowing, it may also be helping slow price increases. The report shows the average purchase loan amount fell to $413,500 last week, down from $460,000 in March, its all-time high. The MBA’s weekly survey started in 1990 and covers 75 percent of all retail residential mortgage applications. Follow the link for more information.

A1 Mortgage

Here at A1 Mortgage, we know how important it is to choose the right house for you and your companion. We have the responsibility to provide you with the best products and the highest level of customer service possible. With hundreds of loan programs available, we tailor a loan specific to your needs. So come get pre-approved and start shopping for your dream home by clicking here!