Approval for a mortgage depends on whether borrowers have met certain standards. How well they meet those standards also determine the terms of the loan they receive. However, these standards are subject to change. Which means, there are times when they’re stricter and times when they loosen. That’s why the Mortgage Bankers Association tracks mortgage credit availability each month – to help potential borrowers know what to expect.

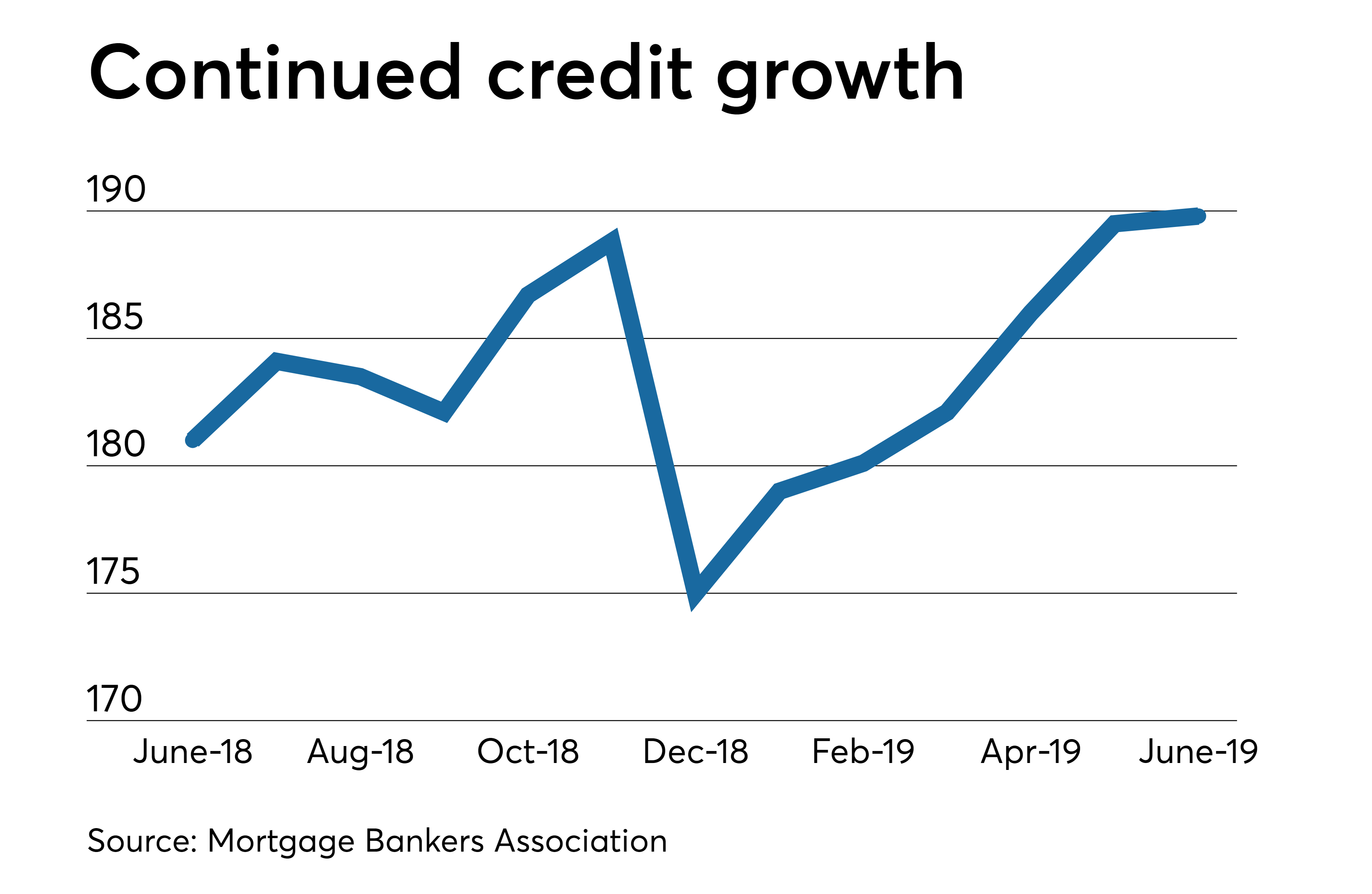

Mortgage Credit Availability Rising Steadily

In April, according to their most recent report, lending standards loosened from the month before, making credit more available. This is after reports that show mortgage rates were steadily rising in March. Joel Kan, MBA’s associate vice president of economic and industry forecasting, says credit availability has improved as the housing market and economy have made gains. “The uptick in credit supply comes as the housing market and economy continue to strengthen,” Kan said. “One trend that has developed in recent months is the rising demand for ARMs, driven by higher rates for fixed mortgages and faster home-price appreciation.” Despite improvements in April, however, credit availability has not returned to last March’s numbers. Follow the link for more information.

A1 Mortgage

Here at A1 Mortgage, we know how important it is to choose the right house for you and your companion. We have the responsibility to provide you with the best products and the highest level of customer service possible. With hundreds of loan programs available, we tailor a loan specific to your mortgage needs. So come get pre-approved and start shopping for your dream home by clicking here!