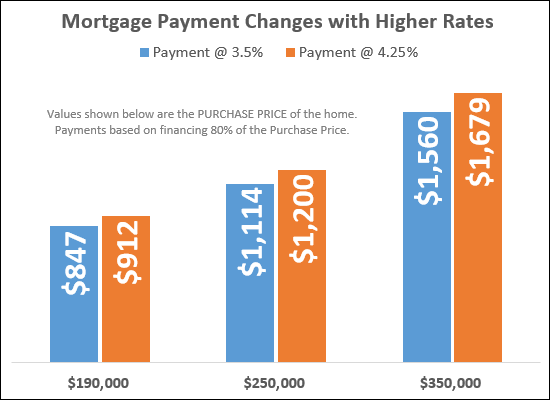

Mortgage rates have been moving higher in recent months. Which means, if you’re currently shopping for a home, your prospective monthly mortgage payment has too. But with rates moving quickly, it can be hard to keep up with what it means for your budget. So what should you know about recent higher rates and how they’ve affected monthly mortgage payments?

Higher Rates Affect Mortgage Payments

Well, the Mortgage Bankers Association’s new Purchase Applications Payment Index tracks median mortgage payments and how they change from month to month. According to the index – which covers data through the end of March – the national median mortgage payment was $1,653 in February. In March, it moved up to $1,736. With rates up about a point over the same time period, that may be less than you expected. Of course, an extra $83 a month makes a difference, especially for first-time buyers. Fortunately, though, the increase was even less for buyers with smaller loans. In fact, the index found borrowers applying for lower-payment mortgages only saw a $35 increase month over month. Follow the link for more information.

A1 Mortgage

Here at A1 Mortgage, we know how important it is to choose the right house for you and your companion. We have the responsibility to provide you with the best products and the highest level of customer service possible. With hundreds of loan programs available, we tailor a loan specific to your needs. So come get pre-approved and start shopping for your dream home by clicking here!