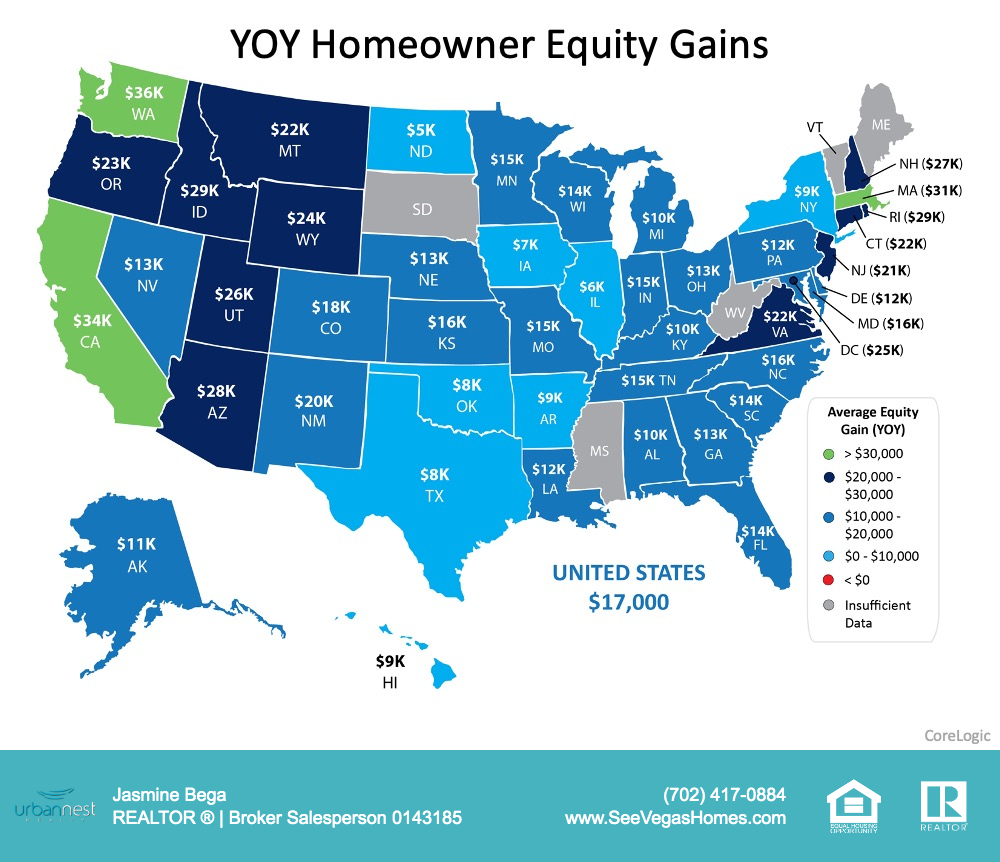

Some of homeownership’s benefits are constant. Stability and the freedom to customize your living space, for example. Others depend a lot upon the ups and downs of the market. Equity is one of them. And these days, because of the market’s continuing strength, homeowners are reaping the benefits in a big way.

Homeowners Equity Gains Continue to Increase

In fact, according to Black Knight Financial’s most recent Mortgage Monitor, surging home values have increased the average mortgage holder’s equity stake by $53,000, for an average of more than $175,000 in available equity per homeowner. Ben Graboske, Black Knight’s president, says the gains are astonishing. “Home price growth in the third quarter – while less than half that of Q2’s history-making rate – added more than $250 billion to Americans’ already record levels of tappable equity,” Graboske said. “The aggregate total of $9.4 trillion is up an astonishing 32 percent from the same time last year and nearly 90 percent higher than the pre-Great Recession peak in 2006.” Increasing equity has also driven the average homeowner’s loan-to-value ratio to the lowest level on record, meaning their home’s value now far exceeds the amount they owe on it. Click on the link for more information.

A1 Mortgage

Here at A1 Mortgage, we know how important it is to choose the right house for you and your companion. We have the responsibility to provide you with the best products and the highest level of customer service possible. With hundreds of loan programs available, we tailor a loan specific to your mortgage needs. So come get pre-approved and start shopping for your dream home by clicking here!