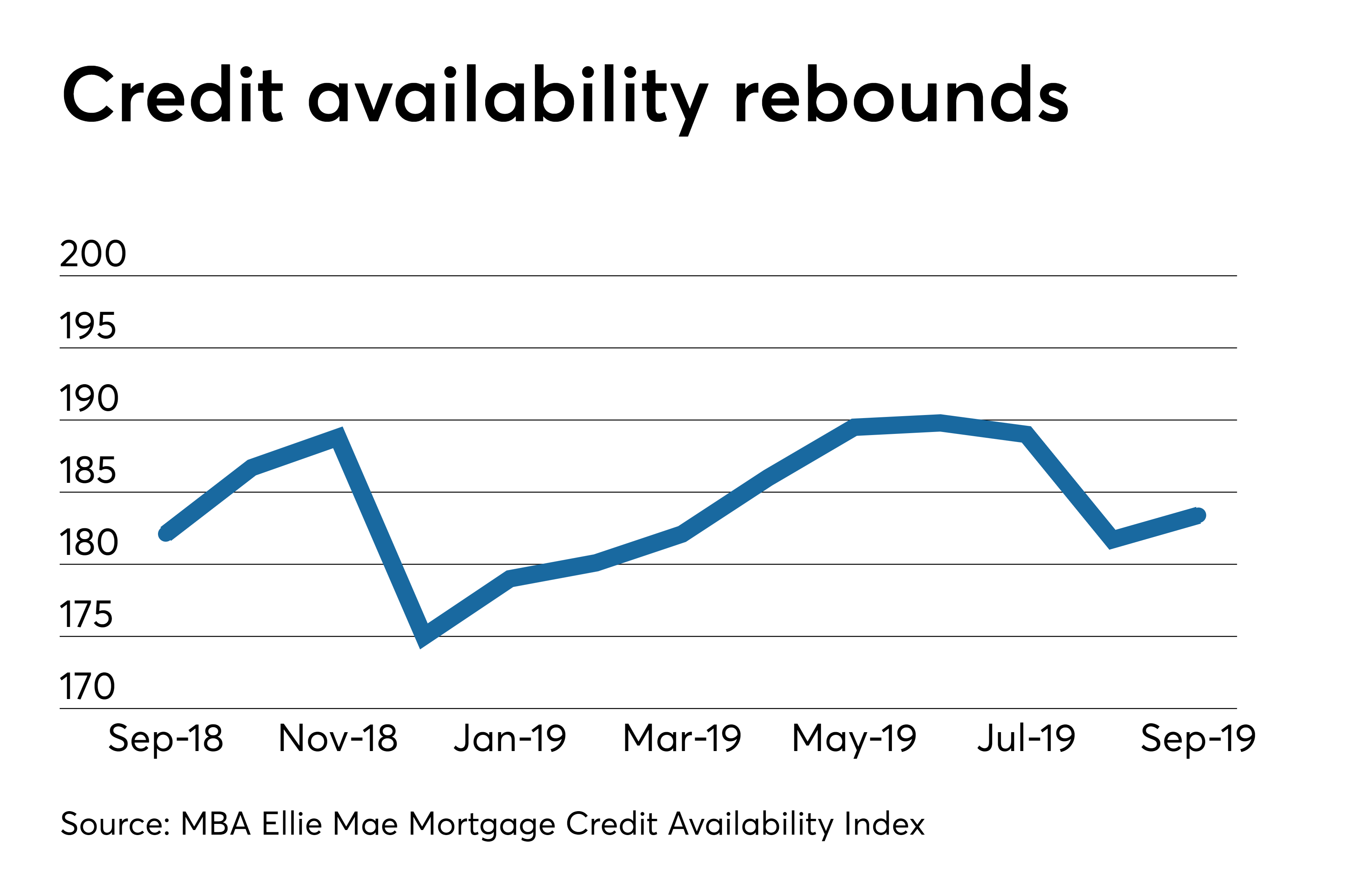

For most of us, buying a house means applying for a loan. After all, homes are expensive, so you’re probably going to need to finance your purchase. But the standards used to determine the terms of that loan, or whether or not you’re approved to borrow at all, aren’t fixed. There are times when your financial situation needs to be in better shape than others in order to qualify for a loan. That’s why the Mortgage Bankers Association takes a monthly measure of mortgage credit availability to see whether it is increasing or decreasing.

Credit Availability Increasing

When lending standards tighten, their Mortgage Credit Availability Index drops. When they loosen, it rises. In July, it was up 0.3 percent over the month before. Joel Kan, MBA’s associate vice president of economic and industry forecasting, says jumbo loan programs saw the most improvement. “Credit availability slightly increased in July, driven by an increase in jumbo loan programs,” Kan said. “The bounce back in jumbo credit availability followed a sharp drop in June, as some investors renewed their interest in jumbo ARM loans for cash-out refinances and investment homes.” Click on the link for more information.

A1 Mortgage

Here at A1 Mortgage, we know how important it is to choose the right house for you and your companion. We have the responsibility to provide you with the best products and the highest level of customer service possible. With hundreds of loan programs available, we tailor a loan specific to your mortgage needs. So come get pre-approved and start shopping for your dream home by clicking here!