As a mortgage company, we are committed to making sure our clients have the best home buying experience possible. We understand that one of the top homebuyer headaches is worrying about their closing date being pushed back. There are a lot of logistics that go into a real estate closing. If you plan for a closing date and move out of one home before you can close on and move into the next, things can get complicated and expensive.

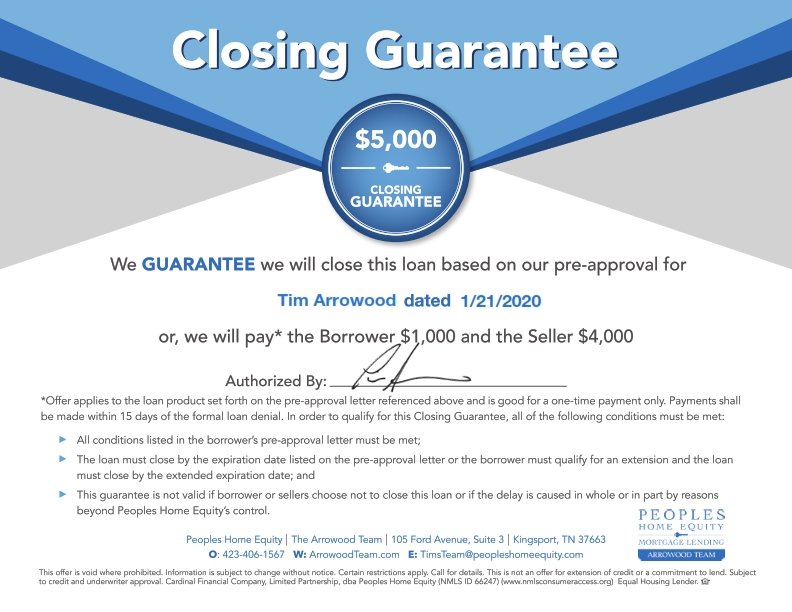

However, at A1 Mortgage we’re so confident in our process, we are putting our money where our mouth is. Our $5,000 Closing Date Guarantee takes the stress and worries out of the mortgage loan process. You can enter into a purchase transaction with confidence knowing you will close on time.

If your loan fails to close on time due to a delay by A1 Mortgage, you will receive a $5,000 credit towards paying for permissible closing costs on your loan with A1 Mortgage.

Here are a few reasons our clients love it…

Your offer is stronger

Closing on time is important to both the Buyer AND the Seller. In today’s competitive market, our Closing Date Guarantee helps you stand out during multiple-offer scenarios. It lets the seller know they can count on your lender to keep the financing on track and helps give them peace of mind.

Less Worry

With the added protection of our guarantee, you don’t need to worry as much about the possibility of unexpected costs due to a delay. If for some reason A1 Mortgage is unable to close your new home purchase on or before your scheduled closing date, you will receive a $5,000 credit towards paying for permissible closing costs on your loan with A1 Mortgage.

Enjoy the Ride

With the Closing Date Guarantee in place, you are able to focus on the exciting parts of your purchase, like the fun of preparing and planning your future in your new dream home.

To learn more about our Closing Guarantee and what it can mean for you during your home buying process, reach out to an A1 Mortgage Loan Officer today.