Could Your Shopping Habits Affect Your Chances of Securing a Mortgage?

Choosing to spend all your money each month will not only drain your bank account, but it can also have a negative effect on whether or not you can qualify for a mortgage. Spending habits do affect your chances of getting a mortgage. Your past spending, saving and financing habits have the ability to boost […]

How Does Paying Off Your Mortgage Affect Your Credit Score?

You’ve completed one of the biggest milestones a homeowner can accomplish: paying off your mortgage – Congrats! With this, a new sense of relief can occur but the prominent question that many have still lingers, how does this affect my credit score? The answer is somewhat specific to each individual, but for many, your credit […]

Closing Costs: How Much to Expect When Saving For Them

After you’ve been approved, and before you’ve made any offers, you have to decide how much money you’re going to spend on the purchase of your home. Typically, closing costs are equal to a percentage of the purchase price. There are a lot of fees associated with the purchase of a home including application fees, […]

Top 5 Things to Avoid After Applying for a Mortgage

Whether you’re looking to move to Kansas City or you’re already here and searching for the perfect house, the mortgage process is the same. It’s exciting to get approved and the process is long. In order to move the process along as quickly and easily as possible, you must be conscientious of all financial decisions […]

How to Close a Home Loan Faster

Are you ready to buy a home in Kansas City? Do you already have one picked out? Then the next step is understanding how to quickly close home loans in Kansas City. 3 Ways to Quickly Close Home Loans in Kansas City It currently takes approximately 47 days to close on a home across all […]

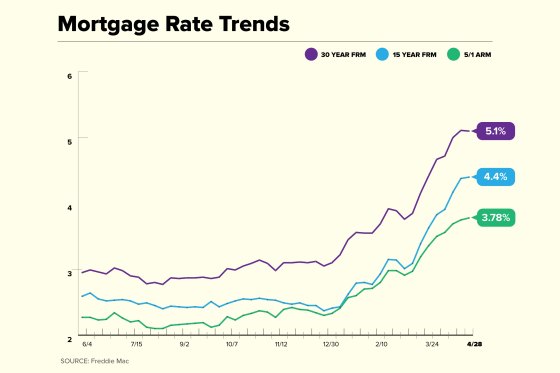

Where Are Mortgage Rates in Kansas City Now?

A lot goes into making the decision to buy a house. You need to think about everything from the home itself, to the neighborhood it’s in, to your commute and so much more. Of course, before you can move forward with a purchase, you first need to know what mortgage rates in Kansas City are […]

Everything You Need to Know About Lee’s Summit FHA Loans

The Federal Housing Administration (FHA) offers some truly life-changing benefits for first-time homebuyers. Applying FHA terms through the right lender gives you extraordinary amounts of leverage when breaking into the homebuyer’s market, especially if you don’t have huge cash reserves or top-flight credit. Before we get into what Lee’s Summit FHA Loans can do for […]

June Spotlight: Meet Karly McDonald

Team Member Spotlight for June: Karly McDonald, Production Coordinator at A1 Mortgage. We interviewed Karly and would like to share some fun facts with you: Q: What is your Favorite restaurant and why? A: Waffle House, there’s something about sitting down with a cup of coffee with my husband on a Saturday morning that makes […]

What Is a USDA Loan?

A USDA loan provides money to individuals purchasing homes in rural areas. Typically, these individuals have low to moderate income to their names. If you’re seeking to purchase, build, improve, modify or rehabilitate a rural property, a USDA loan is the tool you’ll need to get this done. Lenders also receive a sense of protection […]

May Spotlight: Meet Rick Langley

Team Member Spotlight for May: Rick Langley, Sr. Loan Officer at A1 Mortgage. We interviewed Rick and would like to share some fun facts with you: Q: What is your Favorite restaurant and why? A: 3rd Street Social Great food and service Q: What did you think you wanted to be when you grew […]